If there is one company which almost everyone right now has heard of, it is CRED. It might be because of the offbeat advertisements, or for being the IPL sponsor, or because of the money that it is saving you, in the end, you have heard of CRED. You also probably are aware of the insane awards that few CRED users receive during the year, someone wins a Mercedes, someone wins lakhs in cash and the list goes on. All makes us wonder, what exactly is CRED doing?

So, the company was founded by Kunal Shah (also the founder of Freecharge) in 2018, is basically an app through which credit card users get reminders for clearing the outstanding amounts on their credit card in a timely manner - everyone knows this! On timely payment, the user receives “CRED Coins” – 1 CRED Coin = Rs. 1, so if you pay a bill of Rs. 50,000, you receive 50,000 CRED Coins which you can then use to purchase the products of any of the many companies which CRED has partnered with to list on their website.

Now, why does CRED reward us for doing what we already had been doing before it was born?

For this, let’s try to analyze how any new business makes it’s way to the top. Firstly, the business should look to solve a problem, take for example, Reliance Jio, Mukesh Ambani brought the company at a time when the country had a few strong players in the telecom industries and there was barely any internet penetration, Ambani, with Jio, disrupted the entire Industry and made an almost revolutionary change by giving free data and calls to everyone for a year! We can now relate this with CRED, Kunal Shah has identified 4 major problems that he aims to solve with his new company:

Fees for late payments on bills

Interest charges on these late payments

Additional hidden costs because of late payments

Lack of proper credit use and behavior in the country

Now once the problems have been identified, the founder must also find an effective way of solving the problems, and what better way than to provide your service free of cost or load your customers with tons of rewards and gifts?

But then, what is the company trying to accomplish with these reward systems and where does CRED get the money for these rewards?

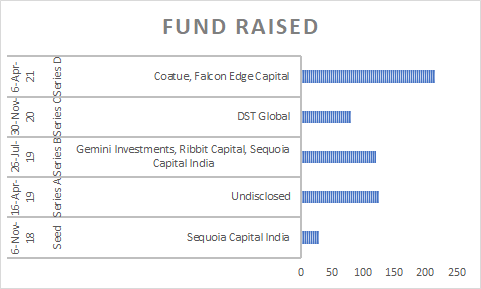

Well, the answer is – raising investments. Believe it or not, three years in business and CRED has had almost negligible revenue from operations – a mere Rs. 52 Lakhs in the previous year. In fact, last year, the Company spent Rs. 727 to earn every Rs.1! Simultaneously in the same year, CRED has also earned it’s position in the Unicorn Club (Startups valued at more than $1 Billion) by raising $215 Million at a $2.2 Billion valuation from Falcon Edge Capital and existing investor Coatue Management LLP. All of this sounds pretty insane, right? On one hand the company has almost no revenue, and on the other, it receives a valuation in the billions.

One thing that most venture capital firms and angel investors assess before investing in a startup is a capable founder or founding team, especially when they are investing in novel ideas. CRED seems to possess just that, a founder with a proven track record in running and successfully exiting a large scale fin tech startup. It is no doubt that Kunal Shah understands the fin-tech business in India pretty well. Another important aspect that has allowed CRED to entice these behemoth investments is the size of the problems it is addressing and the prospects of the whole business in future.

It is not very difficult to understand. CRED, like Jio, has identified a problem and found a solution to the problem – these are the first two phases in the life of a business, in the third stage, the Company needs to raise the funds to solve the problem – how else would they operate? The investors of CRED see great potential in the Company, and rightly so. In the third stage, the Company commences it’s operations and the aim is to create a habit among the users. Once the country had Jio SIM Cards in their phones, nobody looked at the data being consumed, the amount of calls being made – this is a change in the behavioral patterns of the end users. With CRED, it aims to simplify the payment process so much that the user does not see another alternative to it! With this CRED secures the ideal customer base with great credit ratings and high incomes, who will be willing to spend more on their credit cards! And believe it or not, CRED is already on the way to achieve this – as of date the Company controls almost 22% of all Credit Card payments in the country and is spending boatloads of money for gaining and cementing its market share at a rapid speed.

Also, not everyone is allowed access to CRED, it is a member’s exclusive community, to be a part of which you require a CIBIL score of more than 750. Once you do become a member, you are required to pay your Credit Card bills 2 days in advance, on successful payment of which you win the CRED Coins. These CRED Coins are then used by you and me to purchase the products listed by partnering companies of CRED, from which, the company charges a small commission – this amount is not even close to enough for the company to stay afloat.

CRED through its reward system is trying to encourage proper credit use and behavior in terms of timely credit payments in the country. It is creating a creditworthy community by incentivizing its members to maintain a good credit score through timely credit card payments. In doing so CRED is creating and managing a customer base that has high creditworthiness and are among the 3% or almost 52 Million credit card users. CRED is targeting the crème de la crème of the Indian population and creating a database of these people.

Since financial literacy in India is very low, the vast majority of people do not realize the importance of maintaining a good credit score and using leverage to your advantage. In incentivizing its client base the company is creating awareness and also a prospective customer base with a high credit score to cross sell and upsell financial products and other products to this high-income and creditworthy customer base.

The company has already begun using this to its advantage, by providing short term loans WITHOUT any need for verification. These loans come at a very high interest rate of more than 15%, however, a person in need will not think of the interest when they are receiving a loan without any need for verification. For this loan facility, the Company has partnered with IDFC Bank and hence only charges a commission out of the earnings of the bank. It is estimated that Non Banking Financial Companies (NBFCs) and FinTech Companies (like Cred) control approximately 40% of the market personal loans market, and Cred with an already increasing user base gets a great playing ground to cross sell it’s services to the existing customers (it has already disbursed loans to the tune of more than Rs. 1,000 crore till date).

Some other products CRED has begun offering to its customers is an online store with more than 1,800 brands. Customers can use their CRED coins or incentives from making timely credit card payments to get discounts on products of various brands through their E-Commerce store. They have also introduced a payment wallet called CRED pay for enabling easy checkout process through its integrated e-commerce platform. It is evident that CRED is trying explore multiple revenue streams to suck the juice out of its high profile client base.

A major reason for receiving the valuation that it has is the amount of data which CRED owns. With a user base of more than 60 lakh people, CRED possesses literally every minute detail of these users. From their incomes, their Government IDs, their preferences and even spending patterns. While CRED is not leveraging this data as of now, Investors see immense value in this specific asset. Companies like Gartner are willing to pay hundreds of crores to get their hands on such data. And this is the same data due to which CRED does not require any verification before handing you a loan. They have all your details, contact numbers, bank related data and hence has found itself in an almost risk free position, should you get any ideas of running away with CRED’s money! This data collection can also be seen as suspicious and would turn off many with data privacy concerns. Data related to your bank accounts and your spending is something that is extremely private and in the hands of hackers can have a devastating impact. CRED therefore would need to work extensively to ensure data privacy, protection and security.

After this entire discussion, you might even wonder as to why the banks are not going against CRED? After all, the interest charges, hidden costs, late fees do form a substantial part of the Bank’s revenue! So, a bank’s business is simply giving and receiving money, right? You deposit money with the bank, for which you receive an interest and then the bank then gives out this money to another party from which the bank receives interest. Now, for a bank, while these hidden costs etc. do form a good amount of their revenue, the real value still lies in turning around their existing loans and deposits. By this we mean, that the faster a bank receives it’s money, it will be able to give out more as loans, thereby creating much more revenue than through Interests and Fees. Hence, here everyone wins! CRED, for solving a huge problem in the banking system, the banks, for receiving their dues timely, and you and me because of CRED’s amazing rewards!

Now to wind up, let’s first summarize what we have discussed till now. A business has many phases: Phase 1 – Finding a problem; Phase 2 – Solving the problem; Phase 3 – Raising Money and creating a habit amongst the users. CRED is currently in the 3rd Phase of it’s life, it is creating and imbibing a habit amongst the users in such a way that now CRED users see no alternative to CRED. The 4th Phase would be a stage of Irreversibility and complete dependence. A simple example: Google Maps – Since the launch of Google Maps, more and more people have stopped bothering about remembering the routes to a destination which they may need to travel even on a daily basis. Just like this, CRED users will not even attempt to look at any other alternative method of settling their outstanding dues, and this is the phase when the business turns profitable. This is when the valuation truly starts to reflect!

CRED, as of now is simple app which reminds you to pay your bills on time, but the future opportunities are endless. Let’s begin with the simplest – an expense management app, it will recommend you deals modified on the basis of your spending patterns, send alerts when you over-spend. The second possibility could be an easier and simpler way to file your income tax returns. As of now the App shows hidden charges, it could very well find hidden rebates which you may be able to avail after analyzing your spending pattern for the whole year. The third option, a Portfolio Management Company for the users, since CRED already has a deep knowledge about the user. Last and the most obvious option, a databank – The company is generating data with every transaction made by any of it’s 60 Lakh + users, hence the Company is generating future assets every second! And as Mukesh Ambani rightly said, data is the new Oil, I believe we all can now understand the goldmine which the investors and founders of CRED are waiting to uncover!

The future does look bright for the startup in term of potential revenue aspects, and the speed at which it has acquired a market share and a size-able investment also looks promising, but will the company be able to turn out positive cash flows in the long term and increase its market share with the resources it possesses or will it just be another hyped, inflated bubble? Only time will tell.

Lucid article that really describes the startup game well!